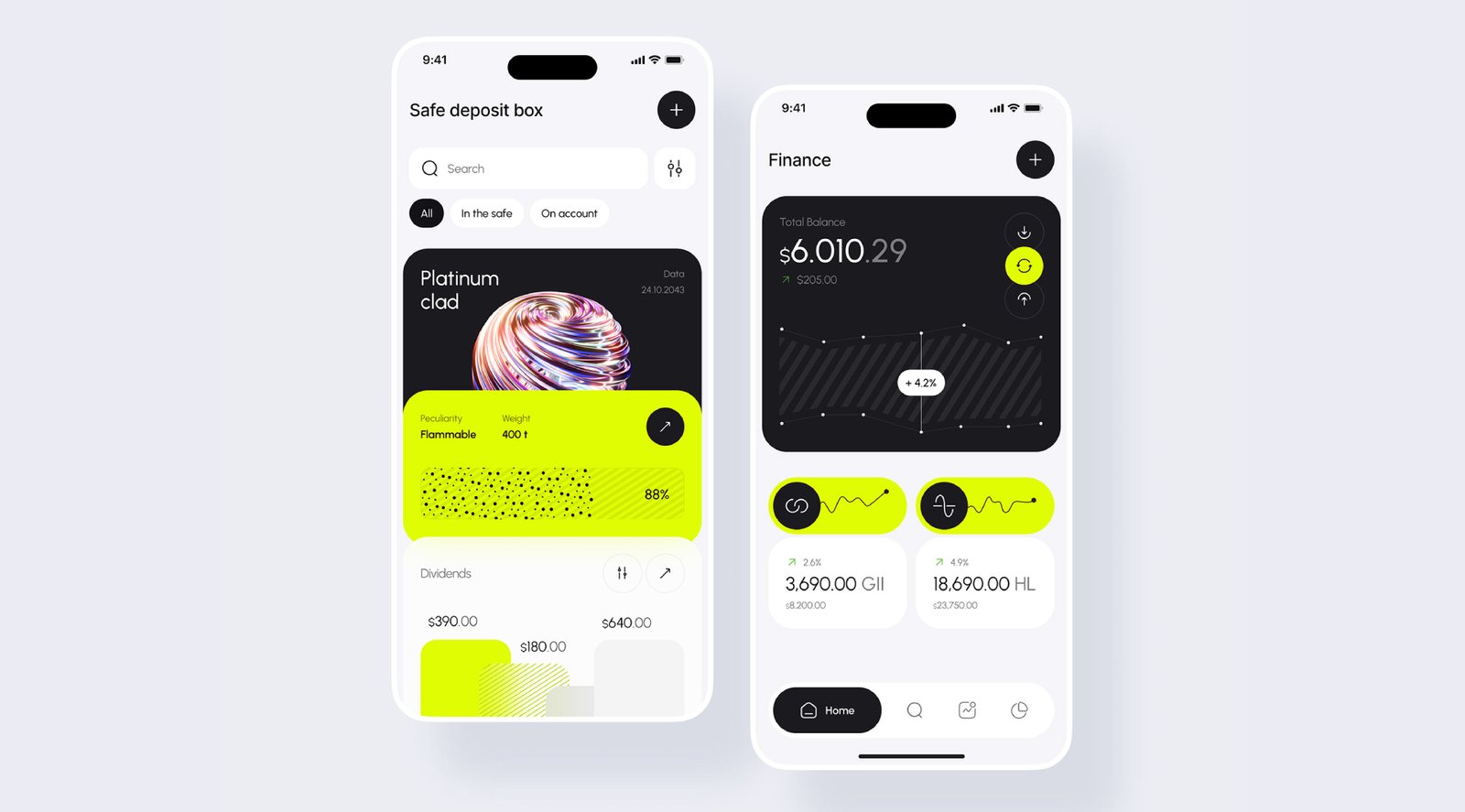

Streamline Your Financial Management

Comprehensive Accounting Solutions Tailored to Your Business Needs

Explore our range of accounting services designed to optimize your financial processes, ensure compliance, and drive business growth with expert guidance and support.

Discover Our Accounting Solutions

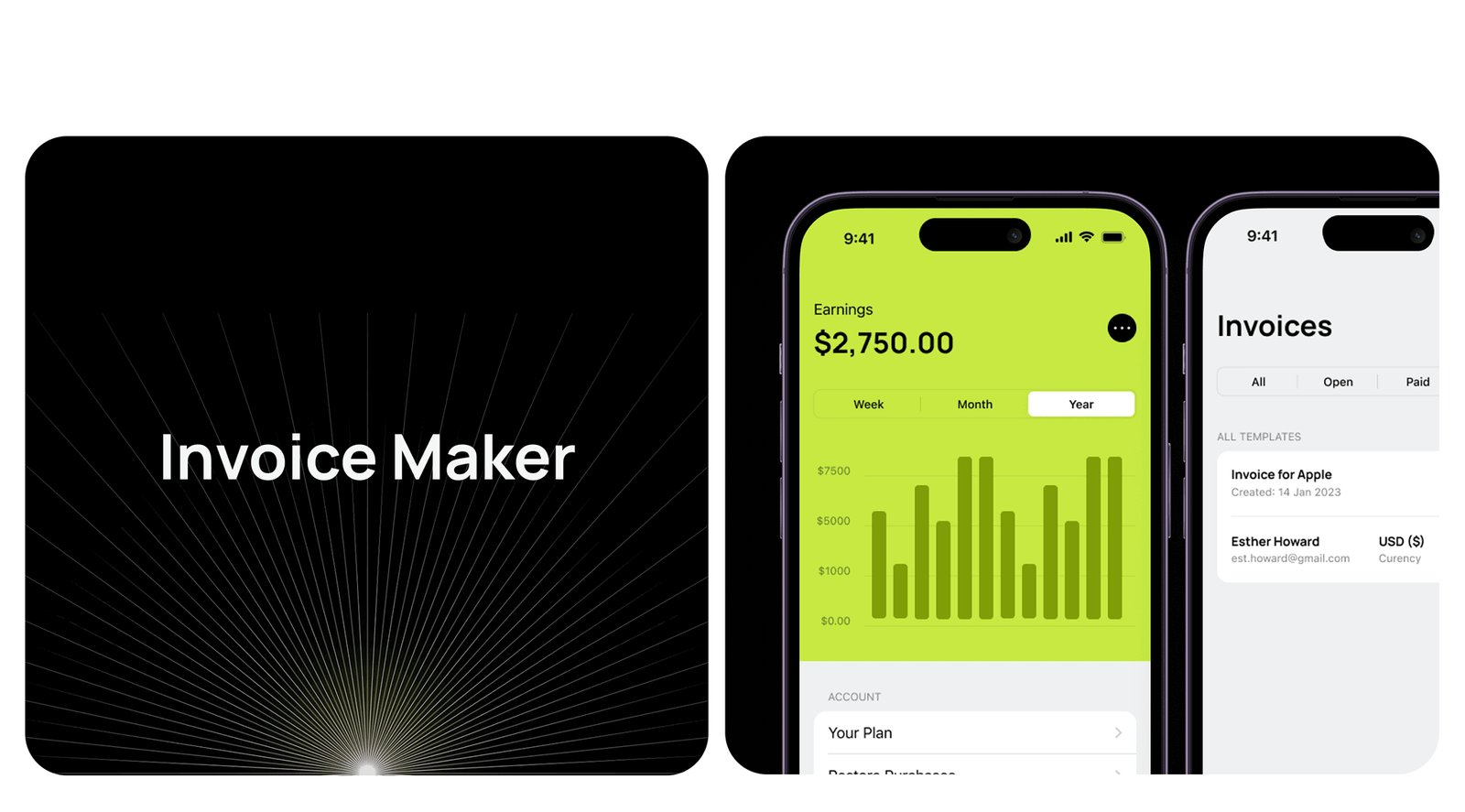

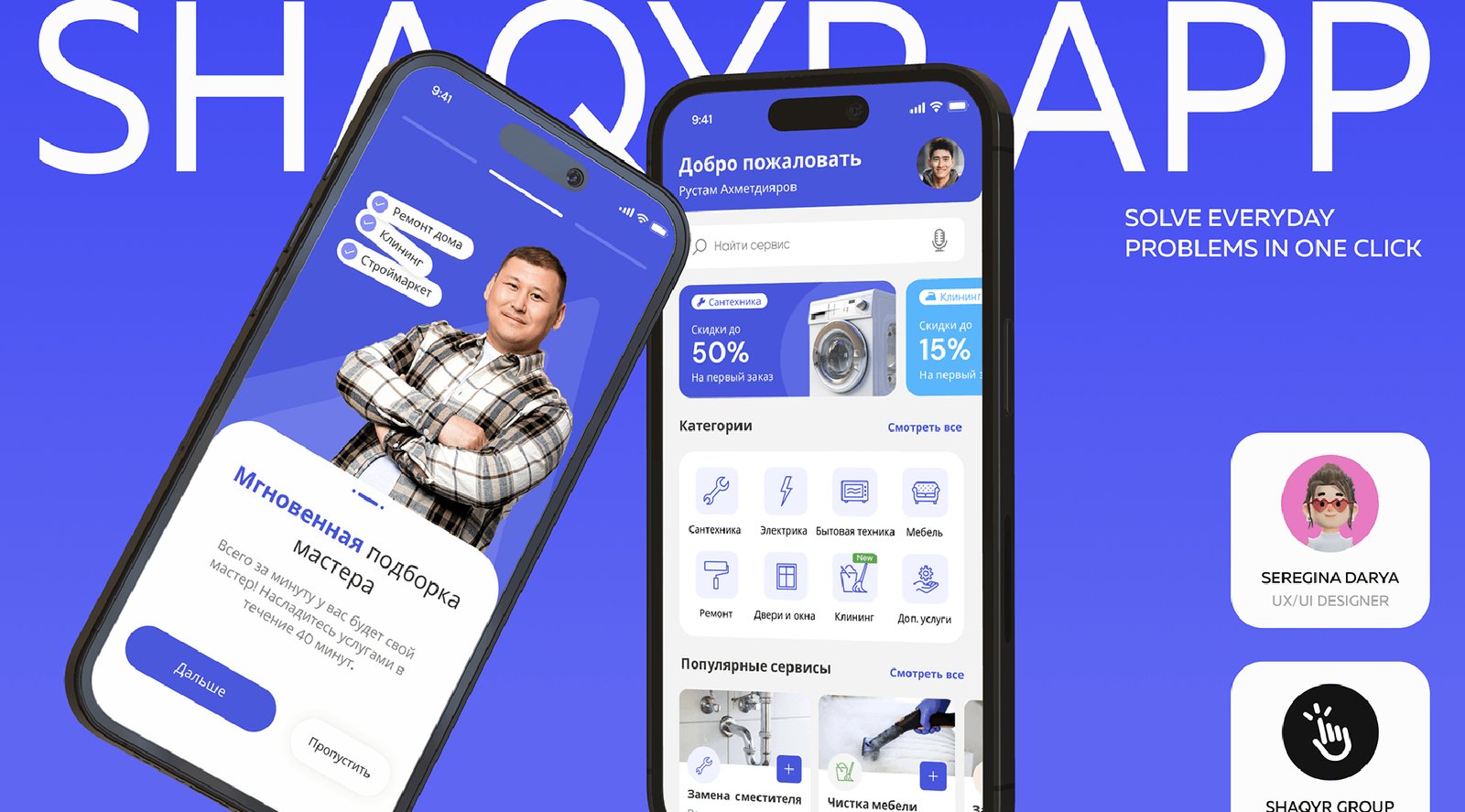

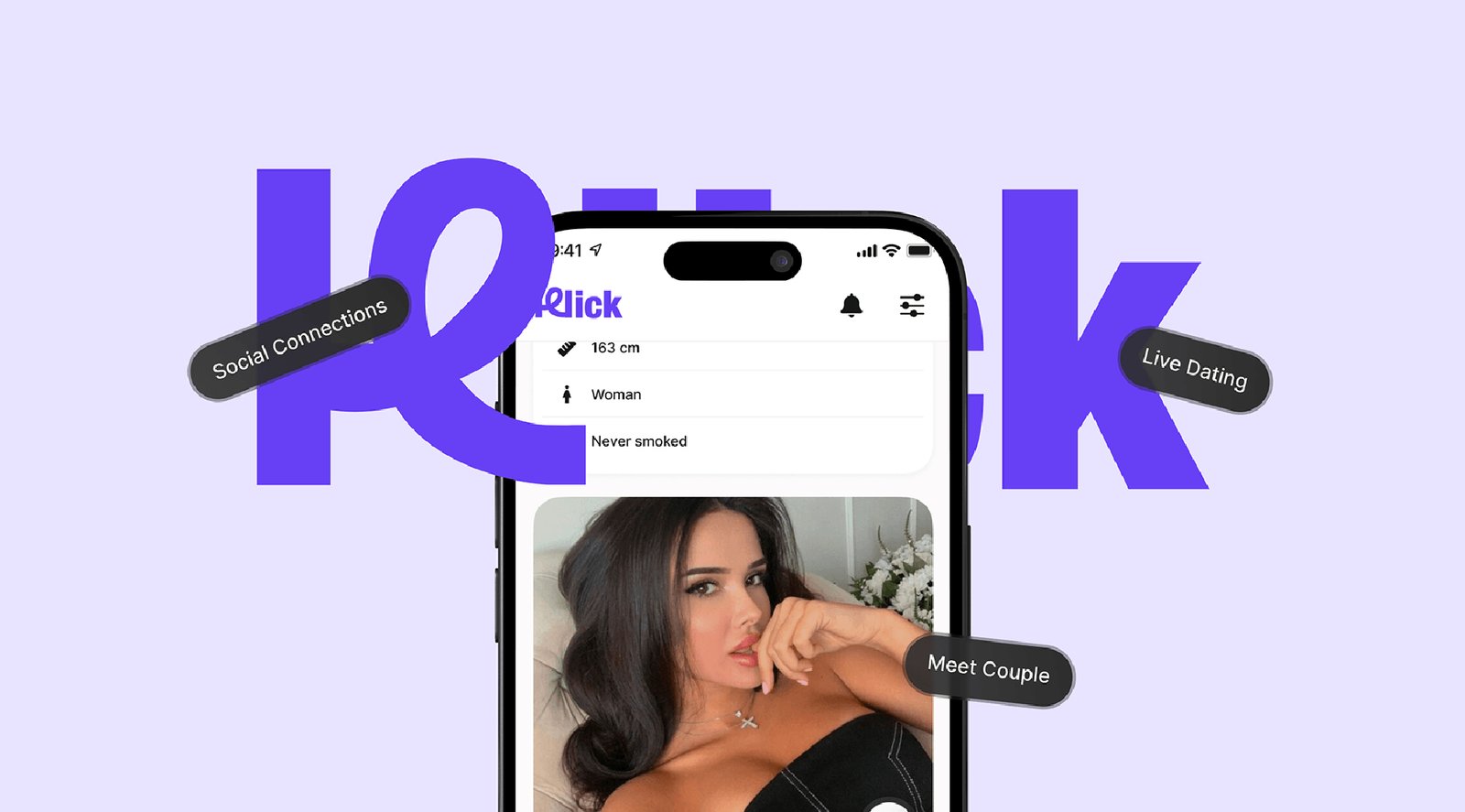

At our company, we’re dedicated to providing top-notch mobile app development solutions tailored to meet your specific needs. Our team of experienced developers works tirelessly to bring your ideas to life, creating sleek and user-friendly applications that not only meet industry standards but also exceed your expectations. Whether you’re a startup looking to establish your presence in the digital world or an established business aiming to enhance your mobile strategy, we’re here to help.

With our collaborative approach and attention to detail, we ensure that every aspect of your mobile app aligns seamlessly with your brand identity and delivers a superior user experience. Partner with us today and let’s take your mobile presence to new heights!

Unlocking the Power of Accounting Services: Key Statistics You Need to Know

Accounting services play a crucial role in businesses worldwide, with studies showing that companies that maintain accurate financial records are more likely to succeed. According to recent research, businesses that invest in professional accounting services experience higher profitability and growth rates compared to those that do not. Additionally, outsourcing accounting tasks can result in cost savings of up to 40%, allowing businesses to allocate resources more efficiently and focus on core operations.

According to a survey by the American Institute of CPAs, 67% of small businesses feel they are “extremely” or “very” knowledgeable about accounting and finance matters.

A study by SCORE found that 40% of small businesses say bookkeeping and taxes are the worst part of owning a business.

According to a survey by Sage, 82% of small businesses feel that working with an accountant helps them make better financial decisions.

Why Your Company Requires Accounting Services

Financial Empowerment Hub: Tailored Solutions for Your Success

Bookkeeping Excellence

Meticulous bookkeeping ensures accurate financial records, forming a foundation for informed decisions and regulatory compliance.

Strategic Financial Planning

We provide expert guidance in financial planning, budgeting, and forecasting, empowering effective navigation of challenges and seizing opportunities.

Tax Advisory and Compliance

Our tax specialists navigate complex tax laws, optimizing strategies, ensuring compliance, and maximizing savings while minimizing liabilities.

Payroll Processing Solutions

Our streamlined payroll services ensure timely and accurate processing of employee salaries, benefits, and tax deductions, enhancing satisfaction and compliance.

Financial Analysis Expertise

Leveraging advanced analytics, we provide in-depth financial analysis to uncover insights, trends, and opportunities, guiding strategic decision-making for business growth.

Audit Support Services

We offer comprehensive audit support, preparing documentation, conducting internal audits, and implementing corrective actions to ensure compliance and mitigate risks effectively.

Cash Flow Management

Our cash flow management solutions optimize liquidity, identify bottlenecks, and implement strategies for efficiency and stability.

Business Advisory Services

Our seasoned advisors offer strategic guidance on business expansion, mergers, acquisitions, risk management, unlocking new avenues for success.

Financial Reporting Excellence

We deliver accurate financial reports, including income statements, balance sheets, and cash flow statements, ensuring transparency and accountability to stakeholders.

LLC Formation and Compliance

Our experienced team facilitates seamless LLC formation and ensures ongoing compliance, safeguarding your business’s legal and financial standing.

Tax Preparation and Filing

Tax preparation involves organizing financial information, calculating tax liabilities, and claiming deductions, followed by filing the completed returns with authorities.

Reach Out and Connect

Contact Now